Real Estate investing made easy and safe

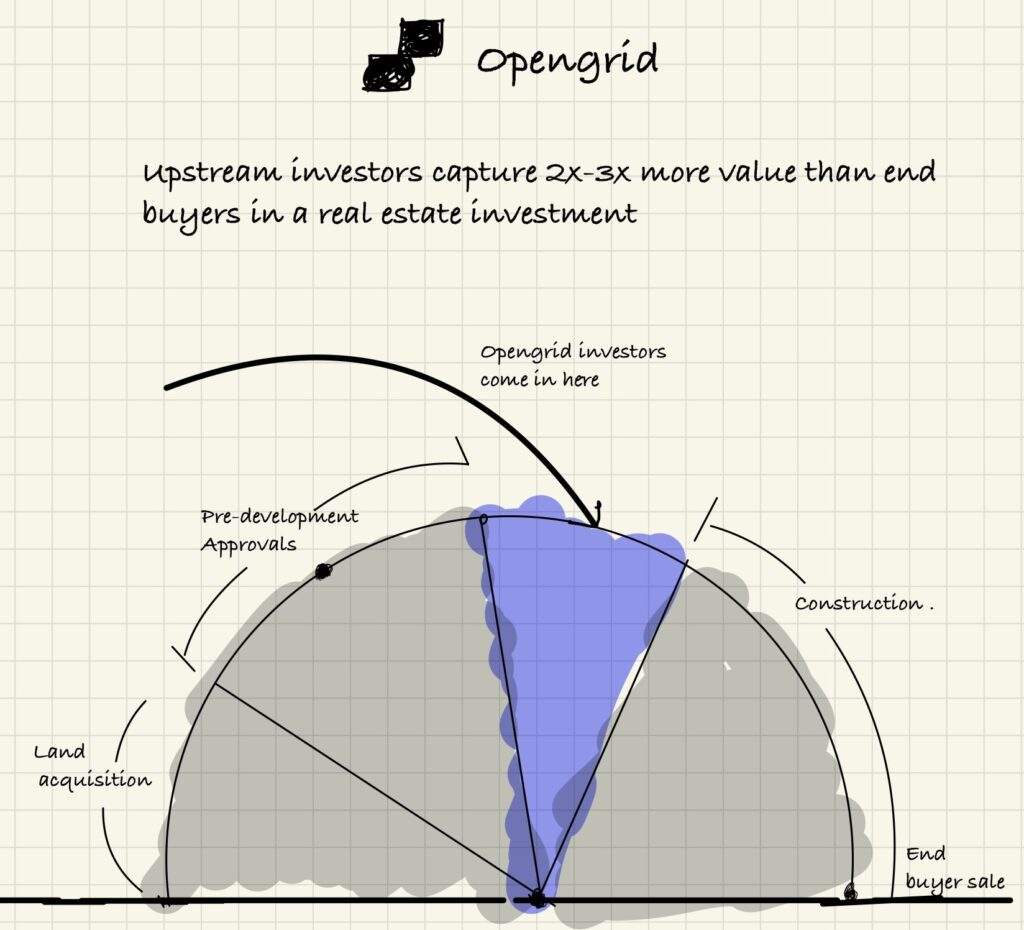

This is real estate investing like never before. Buy into Tier-1 projects with complete transparency, exit at any point of time, and actually earn returns. Get started for less than ₹30,000

This is real estate investing like never before. Buy into Tier-1 projects with complete transparency, exit at any point of time, and actually earn returns. Get started for less than ₹30,000

*Real estate investments are illiquid, risky, and may result in total loss of capital